India Economic Outlook 2025: Growth Slows Amid Challenges

Visual representation of India’s stock market performance and economic indicators in 2025

By Somya Prabhat | newslyy.com

Table of Contents

India Economic Outlook 2025 presents a mixed picture—while the country remains one of the fastest-growing major economies, signs of a slowdown are beginning to surface. Sluggish global demand, rising inflationary pressures, and geopolitical uncertainties are testing India’s resilience. As policymakers navigate a turbulent landscape, growth projections for the year appear more modest than initially expected.

But step out of the headlines, and the reality on the ground feels more… complicated.

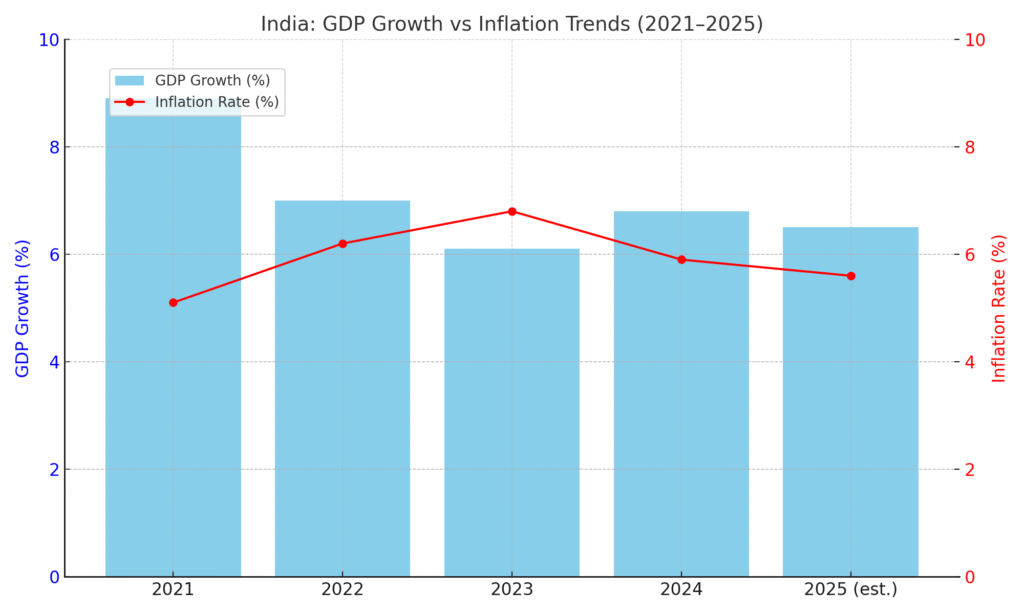

India Economic Outlook 2025 – What the Numbers Say

After years of robust post-pandemic recovery, the India Economic Outlook 2025 reveals a dip in GDP projections. Growth is expected to hover around 6.4%, down from earlier estimates of 6.8%, due to tighter monetary policies and global trade uncertainty.

Inflation and Its Impact on the India Economic Outlook 2025

Persistent food inflation and energy prices are affecting consumption. For millions of households, rising costs are reducing disposable income, directly influencing the overall India Economic Outlook 2025.

Structural Reforms Still a Hope for India Economic Outlook 2025

Despite near-term challenges, long-term reforms in manufacturing, digital infrastructure, and green energy continue to offer a positive foundation for the India Economic Outlook 2025 and beyond.

India Economic Outlook 2025:The Global Chill Factor

Let’s not forget the world around us isn’t in a great mood. War in Eastern Europe drags on, fuel prices are still jumpy, and the US Fed has been playing hardball with interest rates.

India’s exports have felt the chill — down about 4% year-on-year, especially in sectors like textiles, electronics, and engineering. That’s not ideal when millions rely on those industries for work.

Also, investors may be talking about “India as the next China,” but they’re not throwing money around like it’s 2021. FDI inflows dipped by 16% in FY2024, according to Invest India, mainly due to global uncertainty and cautious private equity.

Jobs, Inflation, and That Nagging Worry

Let’s talk about what most headlines skip: jobs.

Unemployment isn’t sky-high, but urban youth unemployment sits stubbornly above 12%, especially for graduates. The problem isn’t just a lack of jobs — it’s a lack of quality jobs.

On the other side, inflation has cooled from its peak, but not enough. The RBI has kept repo rates unchanged at 6.5%, which means business borrowing remains expensive and home EMIs stay heavy.

It’s a squeeze — especially for India’s rising middle class. Groceries, fuel, school fees — everything feels heavier on the wallet.

India Economic Outlook 2025:Some Rays of Light (No, Really)

That said, this isn’t a gloom-and-doom story. Let’s be fair — some things are going well.

- UPI is stronger than ever. Over 15 billion transactions happen monthly — even chaiwalas and autorickshaws are going digital.

- Manufacturing is rising, especially in smartphones and EVs. Apple’s suppliers have expanded production in Tamil Nadu and Karnataka.

- Green energy is getting real. India now ranks in the global top 3 for solar capacity, with over 73 GW installed, and EV sales crossed 2 million units in 2024 alone.

The digital economy is spreading beyond metros. In Tier 2 and Tier 3 cities, edtech, fintech, and e-commerce are booming — creating a new layer of aspiration and opportunity.

What’s the Government Up To?

The Modi government’s 2025 Budget stuck to its strategy: invest in infrastructure, trim the fiscal deficit, and attract foreign manufacturing.

Over ₹11 lakh crore has been allocated to capital expenditure, and key sectors like roads, railways, and energy are seeing long-term bets.

The PLI (Production Linked Incentive) scheme continues to draw major global players, especially in electronics, pharma, and EVs. Over ₹3 lakh crore in commitments have already been made under this plan.

However, bureaucratic delays and skill mismatches remain concerns. Industry leaders say India needs more trained hands, not just more factories.

Rural vs Urban India: A Growing Divide

One aspect often ignored is how rural and urban economies are behaving differently.

- Rural consumption has slowed significantly, hit by weak wage growth and erratic monsoons.

- Urban demand, on the other hand, is more stable, especially in services and digital retail.

Schemes like PM-Kisan and free food grain programs have provided some cushion, but they can’t fully offset the rural slowdown. With over 60% of India’s population still linked to agriculture, this divide could widen if not addressed properly.

The Real Picture: Not a Boom, Not a Bust — Just a Balancing Act

If we go by the basics — rising UPI transactions, foreign investment in manufacturing, and a digital push reaching small towns — there’s no denying India is moving forward. Just the fact that Apple and Tesla’s suppliers are expanding here shows how far we’ve come. Plus, over ₹3 lakh crore has already been committed under the PLI scheme.

But let’s not pretend everything’s perfect.

Inflation’s still biting. Even though the RBI kept it under 6%, essential food items like pulses and vegetables are still expensive for most households. And while the GDP is growing at around 6.9%, youth unemployment in cities remains above 12%, according to CMIE. That’s a big mismatch.

So, is India doing great? In some areas, yes. In others, it’s dragging its feet.

This isn’t the miracle moment people were expecting. But it’s also not a failure. It’s just the economy finding its feet again after a wild few years.

IMF Data Reference:

Even the IMF recently stated that India is likely to remain the fastest-growing major economy in 2025, despite global turbulence.

(Source: IMF World Economic Outlook)FDI Drop Reference via Invest India:

According to Invest India, FDI inflows dipped by 16% in FY2024, mainly due to global caution and tighter monetary conditions.

(See: Invest India – FDI Trends)G7 Summit Reference:

On the global front, tensions around trade and energy prices — discussed heavily during the recent G7 Summit 2025 — are influencing India’s economic outlook.